ESR-REIT, ALog Investors Approve Merger and More Asia Real Estate Headlines

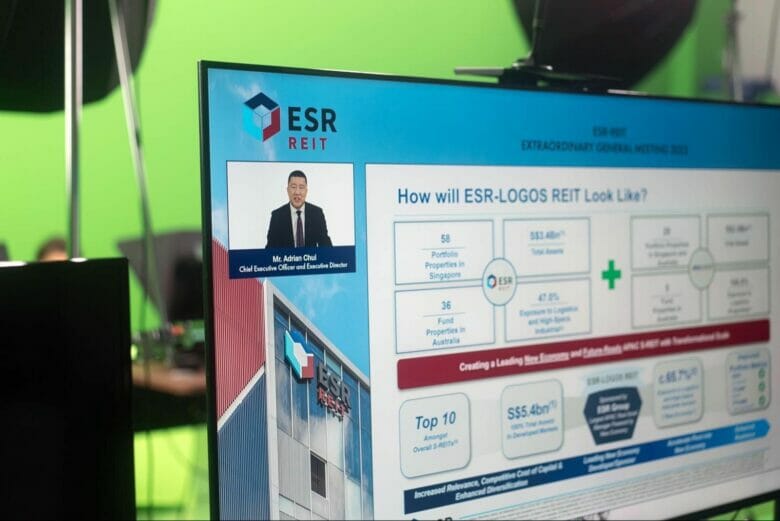

Adrian Chui will soon be helming ESR-Logos REIT

In today’s roundup of regional news headlines, unitholders agree to the merger of ESR-REIT and ARA Logos Logistics Trust, Temasek-backed Cuscaden Peak wins approval to acquire Singapore Press Holdings’ real estate assets, and Hong Kong developer K Wah posts a rare drop in annual core earnings.

ESR-REIT, ALog Trust Investors Approve Merger

The managers of ESR-REIT and ARA Logos Logistics Trust must be heaving huge sighs of relief. After a series of speed bumps, the managers of the two REITs have finally received approval from their respective unitholders to go ahead with the merger to form ESR-Logos REIT.

At an extraordinary general meeting on Monday, 98.6 percent of ESR-REIT unitholders voted in favour of the merger and 98.4 percent agreed to the issuance of new ESR-REIT units to ALog Trust unitholders at an issue price of S$0.4924 each as part of the consideration. Read more>>

Temasek-Backed Cuscaden Wins $2.9B Bid for SPH

A joint venture between CapitaLand, Mapletree and companies controlled by Singaporean tycoon Ong Beng Seng has won approval to acquire Singapore Press Holdings after a rare takeover battle between bidders backed by state investment firm Temasek Holdings.

SPH said shareholders on Tuesday voted in support of the proposal by Cuscaden Peak after an earlier offer by Keppel Corporation had been terminated by the media conglomerate, which is shedding its news and entertainment businesses under a reorganisation plan. The proposal valuing the company at S$3.9 billion ($2.9 billion) was approved by 89 percent of shareholders. Read more>>

K Wah Reports First Drop in Core Earnings Since 2017

K Wah International Holdings, the property developer owned by one of Macau’s biggest casino owners, reported its first drop in annual core earnings since 2017 after a COVID-led tourism slump deprived it of dividends from the gambling business.

The company’s 2021 underlying profit, excluding a revaluation gain on investment properties, fell 17.4 percent to HK$2.93 billion ($374 million) from HK$3.54 billion, K Wah said Tuesday. Net profit taking the revaluation gain into account rose 3 percent to HK$3.4 billion. Read more>>

Lendlease REIT to Raise S$573.8M to Fund Jem Acquisition

The manager of Lendlease Global Commercial REIT is proposing to raise at least S$573.8 million ($422.6 million) to partly finance the trust’s acquisition of the remaining interest in Singapore’s Jem mall.

The fundraising exercise comprises a private placement of at least 448.3 million new units, subject to an upsize option, and a non-renounceable preferential offering of 345.6 million new units, the manager said Tuesday in a bourse filing. Read more>>

Tuan Sing, Mitsubishi Estate to Develop Indonesia Mall for S$90M

Singapore’s Tuan Sing Holdings has partnered with Japan’s Mitsubishi Estate to develop the first phase of a luxury outlet mall in Karawang, Indonesia for an initial S$90 million ($66.3 million).

In a joint statement on Tuesday, the parties said construction is scheduled to commence in the second quarter of 2022, with a target opening date in the fourth quarter of 2023. Read more>>

Japan’s Land Prices Rebounded in 2021 as Economy Recovered

Japanese land prices rebounded in 2021 after a year-earlier drop as the property market recovered from the COVID-19 pandemic’s hit to the economy, a government survey showed.

While Japan’s prolonged COVID-led border controls kept demand for tourism-reliant areas stagnant, the rise of the stay-at-home lifestyle helped housing and logistics land prices recover, the survey found. Read more>>

Advisors See Up to Three Singapore Mortgage Rate Hikes This Year

Mortgage rates in Singapore could be raised three times this year, by 25 basis points each time, according to mortgage advisors polled by the Business Times.

Their projections come after Federal Reserve chairman Jerome Powell’s commitment on Monday to double down on inflation in the United States. Read more>>

Hong Kong Gym Closures Create 500,000 Sq Ft of Vacant Real Estate

A recent wave of forced closures of fitness centres is creating vast areas of empty real estate in Hong Kong and driving down rents, according to industry professionals and property analysts.

The amount of space likely to be vacated by gyms and other fitness facilities being put out of business by the fifth wave of coronavirus may be 350,000-500,000 square feet (32,500-46,450 square metres), according to an estimate by Gordon Yau, chairman of the investigative panel of Hong Kong Fitness Guide, an industry group launched in 2017. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.